Report Nº: 110702/02/2025

It was decided that the referral of contributions to healthcare companies ends. The measure overlooks that the problem is the people with insufficient contributions to cover the PMO. Instead of forcing affiliations, the Solidarity Redistribution Fund should be used to improve financing for lower-income families.

The national health social security system is made up of union health funds (for workers and their families covered by collective bargaining agreements) and management health funds (for executives, professionals and workers not covered by collective bargaining agreements). Originally, affiliation was compulsory to the respective health fund. In the 90’s, free choice among health funds was established. Agreements between the private healthcare companies and some union health funds arose so that higher-income members could refer their contributions to the private company for a fee to the referring health fund. This is known as “contribution derivation”.

Last year, the direct entry of private healthcare companies to the social security system was enabled. Now they can choose to receive the contributions without the intermediation of a union health fund. However, with a strange legal instrument (Resolution 1/2025 of the Cabinet of Advisors of the Ministry of Health) it was established that the affiliates who make “contribution derivation” have to pay directly to the private healthcare company, or else stay with the referring union health fund and receive medical services from it.

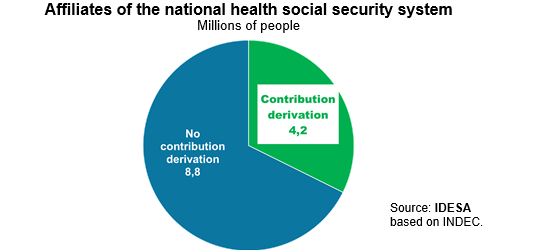

How many people are affected by this new rule? It can be estimated, with information from the 2010 Census, that the composition of affiliation to social security health funds is as follows:

These data show that the people involved in the contributions derivation represent a third of the total. Government coercion implies a very massive change with the risk of generating serious disruptions in the functioning of the private healthcare system. In this sense, it is very suggestive that both the Minister of Health and the Superintendent of Health Services, the regulatory body of social security, excused themselves from signing the regulation so the government had to appeal to the advisors of the Ministry of Health. An improvisation that will surely be questioned for its legality.

One of the main problems of the social security system is that it obliges people with different levels of contributions to provide the same package of benefits (Mandatory Medical Program, PMO). This leads to underfunded families, i.e., it is impossible to finance the PMO with their contributions. In this financial inconsistency, the referring union health funds play a fundamental role. They allow families with sufficient income to have access to a private healthcare company, while underfinanced families are left with partial access to the PMO or often treated in public hospitals. Prohibit the contribution derivation, it is not only questionable from a legal point of view, but it will aggravate the current financing crisis in the private health care system.

To improve the functioning of the healthcare social security system, it is necessary to increase the financing of the underfunded families. If all families were reasonably financed, private healthcare companies would not need the services of the referring union fund since they would be able to provide direct care to all families. This problem can be corrected, at no fiscal cost, by allocating 100% of the Solidarity Redistribution Fund (FSR) to finance the lowest-income families. Automatically distributing the FSR to increase the lowest contributions is a better criterion than the current use that subsidizes the union funds with discretionary and prebendary criteria. Focusing 100% of the FSR on lower-income families is a policy much more consistent with solidarity and freedom.

At the same time, it is very important to organize the PMO by eliminating non-healthcare benefits. For example, social services for disability, addictions, family accompaniment or the financing of innovation in medicines that are very expensive. All these benefits, currently included in the PMO, should be provided by other State agencies, as is the case in well-organized countries.