Report Nº: 110626/01/2025

The partial and transitory export tax reduction is only a palliative for producers and a great fiscal effort for the federal state. This is evidence that the best strategy to eliminate taxes is not a partial one but an integral reorganization of all national and provincial taxes.

The government decided to proceed with a partial and transitory reduction of export tax on the main crops. In the context of low international prices, adverse weather conditions, and an appreciated exchange rate, the government has shown responsiveness to the problems of agriculture. However, it is worrying that the measure is only a palliative for the producers and a great effort for the federal state to maintain the fiscal balance.

The strategy of partial and transitory export tax reductions is in line with the government’s idea of gradually reducing distorting taxes as public expenditure decreases and GDP grows. The difficulties generated by this attempt to reduce only a portion of the export tax –only one of the main distortionary taxes– raise serious doubts about the possibility of moving towards a more generalized reduction of all distortionary taxes.

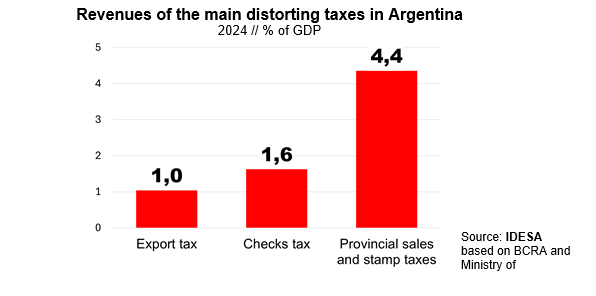

A basic starting point for analyzing the challenges of eliminating distortionary taxes is to quantify their revenues. Considering only the most important distortionary taxes, according to data from the Ministry of Economy referring to 2024, it is observed that:

These data show that the partial reduction of export tax is a necessary but insignificant step besides the challenge of eliminating the main distortionary taxes. If this small reduction of the export tax is very exigent for the national public sector, more challenging will be even to eliminate it and to eliminate the Check Tax as well. It will be even more difficult to make the provinces, with a gradualist approach, also eliminate the provincial sales and stamp taxes.

The case of the reduction of export tax shows that a comprehensive reform strategy is more conducive. The reduction of export tax automatically leads agricultural producers to pay more income tax, VAT, sales tax and stamp tax. This process will intensify as production increases due to better incentives to invest. The result is a paradoxical situation: while 100% of the loss of revenue due to the reduction in export tax is borne by the federal state, most of the increase in revenue from other taxes generated by the export tax reduction is received by the provinces. The provinces receive the increase in the collection of co-participation taxes (income tax and VAT) and provincial taxes (sales and stamp Tax). This contradiction, typical of gradualism, makes tax cuts go at a very slow pace.

A more comprehensive strategy would allow a faster elimination of taxes. In the specific case of the reduction of the export tax, it should be agreed with the provinces that the increases in revenue generated in the agricultural sector should be 100% destined to finance the reduction of other taxes. An alternative could be to create a specific fund –for an approximate magnitude of the increase in revenue generated by the reduction of export tax– in favor of the federal state. In this way, the federal state could advance much faster in the elimination of all distorting national taxes. At the same time, provincial governments should commit themselves to use the revenue increases generated by the reduction of the export tax to reduce their own distorting taxes (sales and stamp taxes).

It is very positive that several governors emphatically supported the idea of lowering taxes. This is an unprecedented opportunity to promote a Fiscal Coordination Agreement between the Nation and the Provinces, being enough a majority –not necessarily all– of the provinces to advance in the integral organization of the Argentine tax system.