Report Nº: 113013/07/2025

Congress approved reforms to the pension system, whose costs exceed the fiscal surplus. This is another failure by the ruling party and the opposition to agree on a joint strategy to rationalize the pension system, thereby achieving equity and sustainability in the fiscal balance.

As a result of the acceleration of inflation that began in 2018 and the manipulation of the pension index rule in 2019, pensions lost 35% of their purchasing power between 2017 and 2023. In 2024, the index rule was changed again to adjust for past inflation. An important detail is that in January 2024, the adjustment was partial as not all of that month’s inflation was taken into account. On the other hand, the policy of reinforcing the lowest pensions with a bonus that has remained fixed at $70,000 since March 2024 continued. In addition, the pension moratorium expired in March 2025.

Part of the opposition in Congress managed to pass a law that increases all pensions by 7.2% —to compensate for the portion of inflation in January 2024 that was not considered—updates the bonus amount to $110,000, and restores the moratorium for two more years. President Milei has already announced that he will veto the initiative because it compromises fiscal balance. The opposition now needs to gather two-thirds of the votes in both chambers to override the veto.

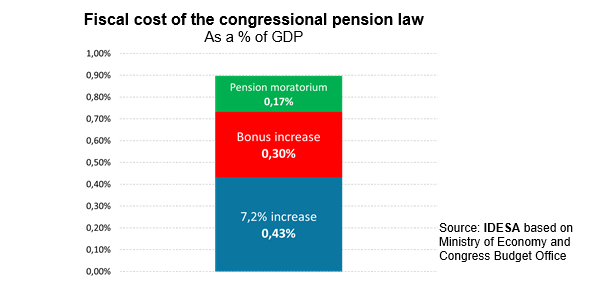

The question that needs to be asked is what the impact of this law will be. According to data from the Ministry of Economy and the Congress Budget Office, it can be observed that:

These data show that the law barely manages to recover the meager pension levels of 2023 but is destabilizing for fiscal balance. It should be noted that the financial surplus achieved last year, which the government plans to maintain this year, is around 0.3% of GDP. In other words, the law will reverse the tight fiscal surplus achieved, which is the mainstay of low inflation. Although the law provides for some measures to increase revenue, they are difficult to implement and have very low potential for generating additional fiscal resources.

The opposition’s argument is based on the weakness of having considered only part of the inflation in January 2024, of having kept the bonus frozen, and of having allowed the moratorium to expire without offering alternatives to those who reach retirement age without having made the minimum 30 years of contributions. The government argues that its application will lead to a return to fiscal deficit. Paradoxically, the changes proposed by the law passed by Congress are far from resolving the profound deterioration of pensions, yet their fiscal impact is decisive in undermining the stabilization plan. The explanation is that the pension system needs comprehensive reform. Not patches that respond more to opportunism than to a desire to provide genuine solutions.

Congress missed the opportunity to initiate this reform process. The starting point should be a thorough actuarial study to build a broad and serious discussion of regulatory changes that will lead to equity and financial sustainability in the system. In the meantime, the most urgent issues must be addressed —without compromising fiscal balance— by eliminating the requirement of a minimum of 30 years of contributions so that people can retire with the contributions they have; establishing that the initial benefit be calculated over the entire working life and not just the last 10 years worked; and improving the Universal Benefit for the Elderly (PUAM) so that it functions as a guaranteed minimum coverage for all people who reach retirement age without contributions.

The passing of a law that does not solve the problems of the pension system but jeopardizes the stabilization plan is a resounding failure of the political system. While the ruling party and the opposition fail to break with the improvisation and opportunism that have prevailed for decades, the pension system continues to deteriorate, with very negative present and future consequences.