Report Nº: 111927/04/2025

In the context of productive stagnation, high inflation caused a strong reduction in real wages, which allowed maintaining the level of employment. In the new scenario of stability, if no progress is made with economic structural reforms, the adjustment will inevitably affect the level of employment.

After two weeks, the official dollar –which had a value of $1,078 when the new exchange rate regime was announced– tended to move to the middle of the exchange rate band of $1,200. It is a remarkable achievement to have installed a more flexible exchange rate regime without major shocks. In this regard, trying to force the exchange rate to the floor of the band is only understood as a short-term action to minimize the pass-through of the devaluation to prices. It is desirable for the dollar to move freely through the middle of the band.

The counterpart of exchange rate tranquility is that competitiveness problems remain in full force. Traditionally in Argentina changes in the exchange rate policy are associated with large devaluations that alleviate the situation of exporters and those who compete with imports. On this occasion, after devaluation difficulties remain and the tendency is the lack of competitiveness to worsen in the future.

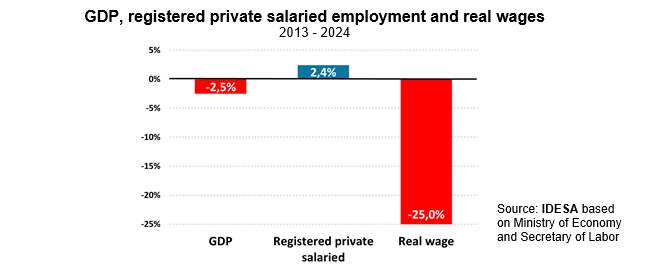

Considering the performance of the economy in the last decade illustrates the dimension and urgency of the pending challenges. According to data from the Ministry of Economy and the Secretary of Labor, comparing the year 2024 with the year 2013, it appears that:

These data show that, in the context of production contraction, employment had a very modest expansion and the key to not destroying formal jobs was the huge drop in real wages. Even with this sharp fall in real wages, very few formal jobs were generated, forcing people to search for jobs among precarious employment. The approximately 3 million new entrants to the labor market were inserted into lower quality jobs, where 40% of them worked as legal single-employed and the remaining 60% as salaried workers or unregistered self-employed. Under this very poor productive and labor performance, it is not surprising that poverty went from 30% in 2016 (the first year it was measured again) to 46% in 2024.

In the last decade, inflation was the mechanism to depreciate real wages sufficiently to maintain formal employment with stagnant production. But success in lowering inflation means that real wage depreciation is not a sustainable tool in the future. Therefore, in the absence of changes in the economy, the adjustment for the lack of competitiveness will now be on employment. Stability makes more explicit the consequences of the bad rules under which the economy operates. A friendlier environment for investment, production and the generation of quality jobs is needed. Taxes and co-participation, labor legislation, infrastructure, social security, education, and world integration are the central issues of the structural policy agenda.

Thus, the structural reform agenda is broad and complex. The biggest challenge is that in most cases it depends on actions that involve more than one level of government. For example, the only way to move towards a new tax system friendly with competitiveness is with coordinated actions between the Nation, the provinces and the municipalities. Much investment is needed in transportation and logistics infrastructure within each province and city, and also in interprovincial works that are the responsibility of the Nation.

In this difficult scenario, the argument that it is necessary to wait until after the October elections to address such structural reforms is weak. On the one hand, because even with a very favorable result the ruling party will still need to build alliances with part of the opposition in Congress. But the most important thing is that after October the governors with whom the reforms must be agreed will continue to be the same as they are today. It is today that the structural agreements reached in the May Act with a federal perspective must be activated.