Report Nº: 112508/06/2025

At the request of the governors, the national government established the Council responsible for implementing the May Act. Structural reforms are essential for the economic plan. Among the most urgent is the elimination of provincial and municipal sales taxes to be replaced by the “Super VAT”.

The stabilization plan is accumulating achievements, and the moment when monthly inflation falls below 2% is not far off. Paradoxically, the faster the progress in disinflation, the more explicit the evidence becomes of the competitiveness problems suffered by large sectors of production on which most urban jobs depend. This will not be resolved by exchange rate policy, but by addressing the distortions that punish competitiveness.

In this context, it is encouraging that at the meeting of governors at the Federal Investment Council (CFI), the national government was urged to move forward with the reforms of the May Act. While the tradition for CFI’s meetings is to result in confrontation with the national government, on this occasion its spokesperson expressed a proactive and constructive attitude. This surely contributed to the national government’s decree creating the May Council, the body responsible for implementing the May Act.

Among the points in the May Act, the reform of the tax system stands out for its importance and urgency. This leads to addressing the main distortive tax: provincial sales tax. Regarding this tax, it should be noted that:

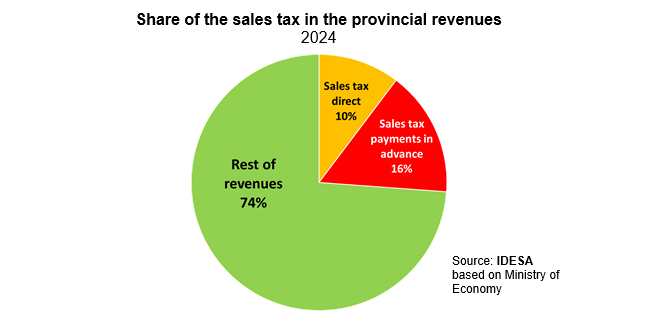

These data show that provincial sales tax is a very important source of financing for most provinces, especially the bigger ones. This means that its elimination is not viable unless it is offset by other sources of financing. It also shows that provincial sales tax collection depends decisively on advance payment systems. Therefore, eliminating advance payment systems is also not feasible without jeopardizing the sustainability of the provinces.

The problem is that provincial and municipal sales taxes are very rudimentary whose negative effects are only slightly mitigated by reducing their rates. For example, they do not avoid the very high administrative complexity, both for the taxpayer and for the State, nor do they avoid legal uncertainty. As it is a sales tax, its exaggerated impact on low-margin activities remains. Advance payment regimes generate credit balances that are very difficult for taxpayers to recover. Nor does a reduction in rates avoid the lack of transparency, as it will remain very difficult to quantify how much these taxes affect the price of final products. Furthermore, these taxes cannot be refunded on exports and put those who compete with imported products at a disadvantage, since imported products do not have the cumulative effect of sales taxes in the successive links of the production process.

Reducing tax rates, as proposed in the 2017 Fiscal Consensus, involves a great effort for provinces and municipalities with little positive impact for businesses. Therefore, it is much more conducive to eliminate the sales taxes and replace them with the “Super VAT.” VAT is less bureaucratic, legally more precise and simpler, less evadable, more transparent in its impact on prices, and neutral for any activity because it taxes added value, not sales, therefore, it does not affect competitiveness.

The “Super VAT” is a way to put into practice the president’s idea of rethinking the distribution of tax revenue. To do this, it is necessary to strengthen the VAT so that it will replace the losses produced by eliminating provincial and municipal sales taxes. The other major challenge is to establish a distribution scheme tending for each province and municipality to finance with the taxes generated in its territory, with a leveling fund to address the underfunding that will occur in the northern underdeveloped provinces.