Report Nº: 111530/03/2025

Probably the main obstacle to the signing of the IMF’s agreement is the government’s reluctance to modify the exchange rate regime due to the impact it could have on inflation. The way to reconcile positions is with a shock of structural reforms as proposed in the May Agenda by Argentina’s government.

The fiscal adjustment is unprecedented and is producing excellent results in terms of inflation reduction. However, there are difficulties recovering reserves because the exchange rate policy was subordinated to the objective of lowering inflation. In December 2023, the reserves were 23 billion, which rose to 30 billion in December 2024, but in March 2025, they fell again to 26 billion dollars and continue to fall.

Faced with this vulnerability, the government decided to negotiate a new agreement with the IMF. It asked to postpone the debt maturities to be paid in the coming years for the current loan and additional funds to strengthen the Central Bank’s reserves. This generated a paradoxical situation. For the first time, Argentina goes to the Fund with the fiscal goals met and, nevertheless, the agreement is delayed. The main barrier likely is that the IMF is reluctant to lend more dollars if the exchange rate policy is not revised and that the government is reluctant to do so, before the elections, because of the possible inflationary impact that would negatively affect its electoral performance.

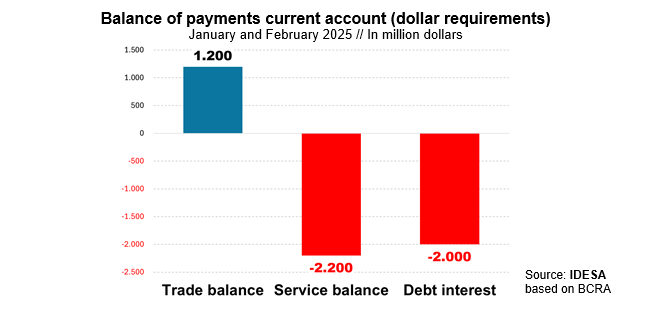

The question to be asked is what support the IMF has to argue that a review of the exchange rate policy is necessary. According to Central Bank data for January and February 2025, it is observed that:

These data show that the Central Bank’s need for foreign currency in the first two months of the year was US$3 billion. This is the difference between the trade balance surplus minus the services balance deficit and the payment of interest on foreign debt. The gap was covered by net capital inflows (external loans minus capital outflows) positive by US$1 billion and consuming about US$2 billion of reserves. This performance lends support to the IMF’s reticence that the most likely outcome of the loan is that it will be consumed by tourism abroad or capital flight.

The dynamics observed in the foreign exchange market suggest that the strategy of maintaining the current exchange rate policy until the elections is counterproductive. On the one hand, it will deepen the loss of reserves. On the other hand, it will affect negatively the productive power of both the exporting sectors and those that have to compete with imports. Both effects do not favor confidence in the performance of the economy.

It may be more convenient to establish a new exchange rate regime that will tend to balance the supply and demand of foreign currency. This implies an exchange rate that discourages imports of goods and services (particularly tourism abroad) and capital flight and encourages exports and capital inflows. Indeed, an increase in the exchange rate to balance the foreign exchange market may generate a resurgence of inflation. However, given that it takes place in a context of fiscal surplus, this impact should be moderate and one-shot. On the other hand, it will help sustain the recovery of production in both exporting and import-competing sectors.

More important than exchange rate flexibility is to accelerate the structural reforms. If a clear and credible signal is given on the implementation of the May Agenda (for example, taking advantage of the expiration of the moratorium to move towards a comprehensive reorganization of the pension system), it would be much easier to bring positions closer to the IMF and the expectations of economic agents would improve. With a shock of structural reforms, the inflationary impact of balancing the exchange market will be much more limited and transitory. Because reforms are the genuine way to improve competitiveness and reduce the country’s risk to facilitate the renewal of the public debt.