Report Nº: 111606/04/2025

The direct impact of Trump’s protectionist measures on Argentina is limited. However, the indirect effects can be very negative. The best strategy is not to copy protectionism but to deepen reforms, including the free trade agreement with the European Union.

The United States imposed a general increase in import tariffs. The floor is a 10% rate, but it is much higher in the case of the European Union, which will pay 20%, Japan 24%, India 27%, Vietnam 46% and China 65%. This will have an immediate inflationary impact on the United States, which will surely lead the Federal Reserve to increase the interest rate. Initial reactions are very negative, as reflected in the sharp and widespread slumps in stock markets around the world.

What is more worrisome is that this unilateral decision by the United States will surely provoke retaliations. The most important will be those taken by the European Union and China, generating a climate of “trade war” between the main economic powers. The consequences will be a world recession with a plunge in international prices. This will affect all countries, even those not directly involved in the “trade war” game.

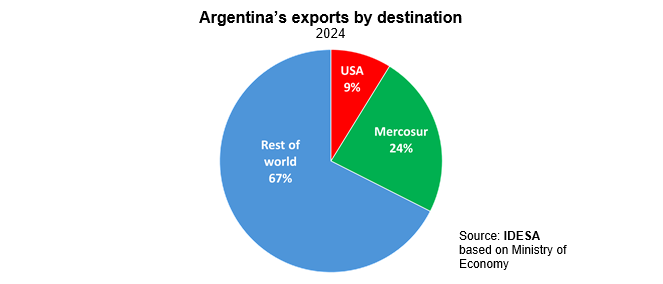

The question to be asked is how this new international scenario impacts Argentina and what challenges and opportunities arise. According to data from the Ministry of Economy on the destination of Argentine exports in 2024 it is observed that:

These data show that the direct impact that Trump’s measures have is small since Argentina destines barely 1 out of every 10 dollars of its exports to the United States. However, the indirect effects, not only due to the decisions taken by the United States but also the possible retaliations adopted by other countries, can be very harmful. The main conclusion is that the international context that Argentina will face is extremely complex and uncertain, making it very difficult to make predictions.

Economic theory holds that, although the damage will be general for all countries, the one that will suffer the most will be the same United States. Businesses will face cost increases as imported inputs become more expensive and consumers will face higher prices as both domestic and imported goods become pricier. Shutting down the economy may create more jobs in certain sectors, but it will come at the cost of efficiency losses. Moreover, if the Federal Reserve chooses to combat rising inflation with interest rate increases, the recessionary effect will prevail. For all these reasons, it cannot be ruled out that the United States will rectify its protectionist strategy sooner than later.

In any case, the worst mistake Argentina can make is to emulate Trump’s policies. Surely, given the evidence that the world is moving towards protectionism, the pressures for Argentina to accentuate its isolation will be exacerbated. It should be borne in mind that, excluding Mercosur, Argentina already applies variable import tariffs that, on average, range around 14% (higher than Trump’s general tariff) and reach 35% on some products. Adding is a host of para-tariff barriers. In this context, reinforcing protectionism, far from contributing to increase employment and production, will strengthen the economic stagnation that Argentina has been dragging since 2012.

On the contrary, the challenging international scenario demands accelerating structural reforms in search of greater competitiveness. One of them, included as point 10 in the May Agenda, is integration to the world. In this regard, never before have the conditions been so fitted to sign the long-delayed free trade agreement between Mercosur and the European Union. This would have enormous economic benefits and would be consistent with safeguarding the democratic and politically liberal values that are at stake in international geopolitics.