Report Nº: 110809/02/2025

The President stated that a real dollar lower than the historical one is consistent because conditions are very different from those of the past. He displayed solid arguments over it. But there is also evidence of factors that reduce competitiveness compared to the past, such as the increase of distortionary taxes.

In a newspaper article, President Milei questioned economists for reiterating warnings about the real exchange rate appreciation. The main argument is that comparing the current level of the exchange rate with the historical average or with any other particular moment is an incorrect approach since current conditions are very different from those of the past. He emphatically points out that, unlike in the past, there is currently a fiscal balance and the hydrocarbons and mining sectors have enormous potential to generate foreign currency. This would justify a cheaper dollar.

One of the comparisons is with the convertibility (1991 – 2001). The president states that the current real exchange rate is similar to that of the ’90s, but having a fiscal surplus and the potential dollars from oil, gas, lithium and copper projects give the current exchange rate greater sustainability than in the convertibility era.

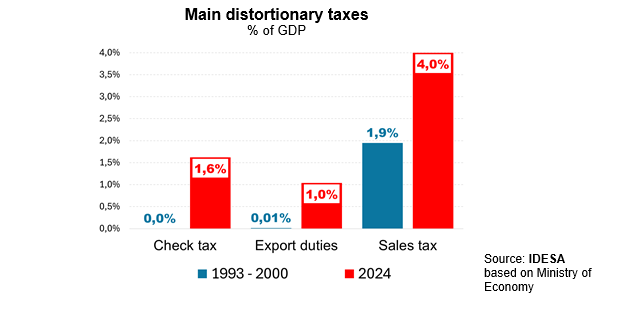

The question to be asked is which are other conditions that differentiate competitiveness from the past, such as taxes. In this sense, according to data from the Ministry of Economy it is observed that:

These data show that, in terms of distortionary taxes, which are those that destroy competitiveness, in the ‘90s there were very different conditions compared to the current one. During the convertibility period, there was no Check tax and practically no Export duties. The provincial Sales Tax imposed a tax pressure that was half of the current one. In addition, in the 90’s there were no systems of withholding Sales tax that generates high bureaucracy and legal insecurity. To this situation, the Stamp tax and the growth of municipal taxes on industry and commerce with more distorting impacts than the Sales tax must be added.

While there are factors that positively differentiate the current situation compared to the past, there are others that have a negative impact. One that is particularly important from the point of view of competitiveness is distortionary taxes. Clearly, in the last decades, the bad tax policy has been eroding competitiveness since it is very difficult to export or compete with foreign products by paying taxes on Checks, Export Duties, Sales tax, Stamp tax and municipal taxes.

The loss of competitiveness derived from bad taxes is not solved with a devaluation but by eliminating those taxes. The government proposes a gradual reduction of taxes compensated with expenditure cuts to preserve fiscal balance. The weakness of this strategy is that the elimination of distortionary taxes will be too slow for the needs of domestic businesses to recover competitiveness. A very illustrative example is the recent reduction of Export duties. For the State, this implies an important austerity effort in order to maintain fiscal balance. For the agricultural and livestock sectors, the government’s effort is insufficient relief.

For this reason, it is necessary to advance in the reduction of the tax burden by making the more neutral taxes absorb the more distorting ones. For example, VAT should absorb Sales and municipal taxes. Only in this way it is possible to eliminate the two most distorting taxes that destroy the competitiveness. As stated by President Milei, it is not clever to insist on the exchange rate appreciation. More pertinent is to talk about and work on reverting the factors that reduce the competitiveness of the domestic economy, such as the distorting taxes.